What You Need to Know

Filling the Gap

In today’s business landscape, companies of all sizes rely heavily on mechanical, electrical, and pressure equipment to keep their operations running smoothly. From large manufacturing plants to small businesses, equipment breakdowns can disrupt daily operations and lead to significant financial losses.

While most business owners focus on traditional risks like fire or theft, the breakdown of essential equipment is more common and, unfortunately, often overlooked.

Standard property and business owner policies usually don’t cover losses due to mechanical or electrical failure, leaving businesses with gaps in their coverage.

Equipment Breakdown Insurance fills this gap, ensuring that when a key piece of machinery fails, the business is protected from financial disaster.

What is Equipment Breakdown Insurance?

Equipment Breakdown Insurance

(formerly known as Boiler and Machinery Insurance) is a specialized coverage that protects businesses from losses caused by the sudden and accidental failure of important equipment.

This insurance is crucial because the risks associated with equipment failure are not typically covered by standard property insurance.

Key Coverage Definitions

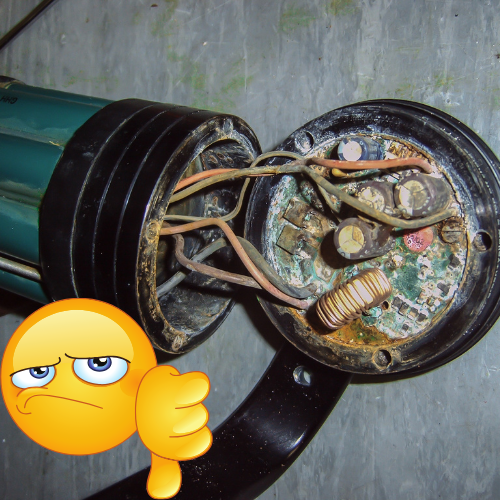

Breakdown: Refers to the direct physical loss or damage to covered equipment due to:

Breakdown: Refers to the direct physical loss or damage to covered equipment due to:

- Failure of pressure or vacuum equipment

- Mechanical failure (including rupture or bursting caused by centrifugal force)

- Electrical failure, including arching

However, a breakdown does not include losses due to:

- Normal maintenance issues like calibration, cleaning, or adjustment

- Wear and tear, corrosion, or rust

- Computer viruses or software-related failures

Covered Equipment

Equipment Breakdown Insurance covers a broad range of machinery and systems vital to daily operations. Covered equipment typically includes:

- Boilers and pressure vessels

- Electrical distribution systems

- Heating, ventilation, and air conditioning (HVAC) systems

- Refrigeration systems (including lost refrigerant)

- Production equipment used in manufacturing

- Computer and communication systems

- Security and fire detection systems

- Office equipment, including cash registers

- Elevators, escalators, and lifts

Coverage Provided by Equipment Breakdown Insurance

Property Damage

Property damage coverage applies to direct physical loss or damage to covered property resulting from the breakdown of equipment.

Unlike standard commercial property insurance, which covers external perils like fire or storm damage, this coverage is specifically designed for equipment failures.

Expediting Expenses

In the event of equipment failure, businesses often need to make temporary repairs to resume operations quickly.

Expediting expenses coverage covers the additional costs required to make those repairs or to expedite permanent fixes, reducing downtime.

Business Income and Extra Expense

A breakdown can cause significant interruptions to your business operations.

Business income coverage ensures that your company is compensated for lost income during the time it takes to repair or replace the damaged equipment.

Extra expense coverage reimburses you for additional costs incurred to minimize business interruptions.

Spoilage Damage

For businesses that rely on refrigeration or storage of perishable goods, an equipment breakdown can lead to spoilage.

Spoilage damage coverage protects against the loss of raw materials, products in progress, or finished goods that are damaged due to a lack of temperature control.

Utility Interruption

If your business experiences a utility outage due to equipment failure, utility interruption coverage steps in.

This extended coverage protects you from the financial impact of power, water, or communication service interruptions caused by an equipment breakdown.

Brands and Labels

In the event that branded merchandise is damaged due to an equipment breakdown, this coverage ensures that damaged goods are properly disposed of or rebranded, while also compensating for the loss of product value.

Loss Conditions and Claims

Similar to other commercial insurance policies, Equipment Breakdown Insurance includes standard loss conditions such as abandonment, appraisal, and subrogation.

This coverage form also includes a provision for defense costs, meaning the insurer may cover legal expenses if your business faces a lawsuit due to equipment-related issues.

Unique Suspension Provision

One distinctive feature of equipment breakdown insurance is the suspension provision.

If an insurer determines that specific equipment is in a dangerous condition, they can immediately suspend coverage for that equipment until the issue is addressed.

This ensures that businesses maintain safe operating standards, protecting both employees and equipment.

Extended Coverages

Additional coverages that can enhance your policy include:

- Business Interruption: Compensates for lost revenue during downtime caused by equipment failure.

- Utility Interruption: Covers losses stemming from a utility service disruption caused by a breakdown.

- Spoilage Coverage: Protects perishable goods from damage due to refrigeration failure.

Common Equipment Breakdown Insurance Exclusions

Like all insurance policies, equipment breakdown coverage has specific exclusions. It generally does not cover:

- Normal wear and tear or gradual deterioration

- External causes like fires, floods, or vandalism (these are typically covered by property insurance)

- Lack of maintenance or neglect

- Rust or corrosion that develops over time

Why Equipment Breakdown Insurance is Essential for Businesses

Difference from Standard Property Insurance

It’s important to note that standard property insurance does not cover breakdowns caused by mechanical or electrical failure. Property policies are designed to protect against external forces, while equipment breakdown insurance fills the gap by covering internal failures such as short circuits, power surges, or compressor failures.

Who Needs Equipment Breakdown Insurance?

If your business relies on machinery, refrigeration, heating systems, or computer technology, you should seriously consider adding this coverage.

Industries that typically benefit from equipment breakdown insurance include:

- Manufacturing plants

- Restaurants and food services

- Retail stores

- Medical and diagnostic facilities

- Data centers and IT firms

In these industries, equipment failures can lead to costly repairs, lost revenue, and prolonged downtime.

Having this coverage provides peace of mind, ensuring your business can recover quickly from unexpected breakdowns

FAQs

1. What does equipment breakdown insurance cover?

It covers the repair or replacement of equipment damaged by mechanical, electrical, or pressure systems failure, as well as the costs associated with business interruption, spoilage, and utility interruption.

2. Does my standard property insurance cover equipment breakdowns?

No, standard property insurance typically does not cover losses from internal mechanical or electrical failure. This is where equipment breakdown insurance fills the gap.

3. Is utility interruption covered under equipment breakdown insurance?

Yes, as long as the utility interruption is caused by a breakdown of covered equipment, it can be included in the policy.

4. What types of businesses need equipment breakdown insurance?

Any business that relies on equipment for daily operations—like manufacturers, retailers, and restaurants—can benefit from this coverage.

5. How does the suspension provision work?

If an insurer finds that certain equipment is in a dangerous condition, they can immediately suspend coverage for that specific equipment until it is repaired or replaced.

Protecting Your Business

Equipment breakdowns are inevitable, but their impact doesn’t have to be devastating.

With Equipment Breakdown Insurance, businesses in Miles City, Montana and the surrounding counties, can protect themselves from the high costs associated with unexpected mechanical or electrical failures.

By covering repair costs, spoilage, lost income, and more, this policy keeps your operations running smoothly, even when the unexpected happens.

We Want to Help You!

If you’d like to learn more about protecting your business with equipment breakdown insurance, Armor Insurance Agency is here to help.