Federally Subsidized Livestock Insurance

The Basics

Livestock producers face many challenges when it comes to managing risk in their operations. Market price fluctuations, production costs, and unpredictable events can significantly impact profitability. Federally subsidized livestock insurance helps mitigate some of these risks, providing an essential safety net for producers. These insurance products, administered by the USDA’s Risk Management Agency (RMA) and backed by the Federal Crop Insurance Corporation (FCIC), offer discounted premium rates through partnerships with private insurance companies.

Whether you’re new to livestock insurance or looking to better understand your options, this guide covers the basics you need to know about federally subsidized livestock insurance, including the types of coverage, what is included, and how to qualify.

What Is Federally Subsidized Livestock Insurance?

Federally subsidized livestock insurance is part of a broader initiative under the Federal Crop Insurance Corporation (FCIC), which promotes economic stability in agriculture by offering insurance products that help producers manage risk. The USDA Risk Management Agency (RMA) oversees these programs, while the FCIC partners with private insurance companies to sell the livestock insurance policies directly to producers.

These policies provide subsidies to help reduce premium costs, making them a more affordable option for livestock producers to manage risks. Importantly, the rates and premiums for these subsidized policies are standardized, meaning they are the same regardless of which private company sells the policy.

Why Your Operation Needs Livestock Insurance

Livestock producers face financial risks beyond their control, such as market volatility and production costs. Here’s why you might consider federally subsidized livestock insurance:

- Risk Mitigation: Protects against unexpected market price declines or decreases in gross margin.

- Affordability: The federal government subsidizes part of the premium, making coverage more affordable.

- Consistency: Standardized rates across providers ensure a level playing field for all producers.

Types of Federally Subsidized Livestock Insurance

There are two primary types of livestock insurance policies available through the FCIC:

Livestock Gross Margin

(LGM)

Livestock Gross Margin (LGM) protects the producer’s gross margin (the difference between expected revenue and feed costs). It uses futures prices or adjusted futures prices to determine the expected and actual gross margin at the end of the insurance period.

What LGM Covers:

- Protects your gross margin, ensuring you can maintain profitability even if market conditions change.

- Uses futures prices to determine gross margin, providing financial protection against unexpected shifts in market pricing.

What LGM Does Not Cover:

- Death, illness, or loss of livestock.

- Decreases in milk production or feed consumption.

- Other forms of damage or loss to your animals.

Livestock Risk Protection

(LRP)

Livestock Risk Protection (LRP) is designed to protect the producer from declines in market prices during the insurance period. If the actual ending market price/value is lower than the expected ending market price/value, LRP pays out an indemnity to make up the difference.

What LRP Covers:

- Protects against a market price decline, providing coverage based on price changes during the insurance period.

- Allows you to choose from a variety of coverage levels and insurance periods to match your marketing schedule.

What LRP Does Not Cover:

- Death or poor performance of livestock.

- Market losses due to anything other than price declines.

- Only covers eligible livestock such as swine, fed cattle, and feeder cattle.

How to Qualify for Federally Subsidized Livestock Insurance

Before purchasing a federally subsidized livestock insurance coverage, a producer must first be deemed eligible. Here’s how the process works:

Submit an Application

Producers need to submit an application to establish eligibility for a policy. This application does not attach insurance coverage right away but determines your eligibility. Once approved, a policy is issued. You can maintain eligibility for coverage i.e., the policy, as long as you comply with the policy requirements.

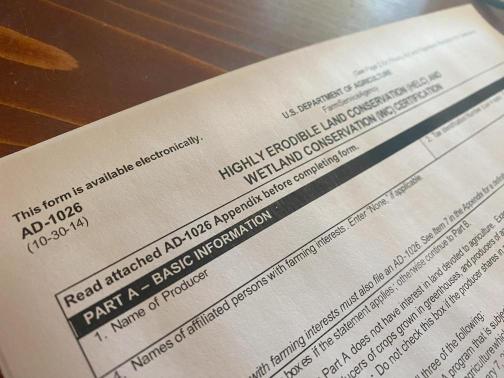

File Form AD-1026

To qualify for the federal subsidy, producers must file Form AD-1026 with their local Farm Service Agency (FSA). This form certifies compliance with conservation provisions and is a crucial step in obtaining eligibility for federal crop insurance premium subsidies.

What Form AD-1026 Covers:

- Certification of Compliance with Highly Erodible Land Conservation (HELC) and Wetland Conservation (WC) provisions.

- Continuous Certification unless there are operational changes that require an update.

- Eligibility Determination for USDA programs, including livestock insurance.

What Does Federally Subsidized Livestock Insurance Not Cover?

While livestock insurance provides valuable protection, there are limitations. Here’s what it does not cover:

- Death or illness of livestock.

- Unexpected losses in feed consumption or production.

- Poor livestock performance or issues related to animal care.

- Property damage or non-livestock-related business losses.

These limitations mean that while livestock insurance is a valuable tool, it’s important to combine it with other forms of coverage to ensure comprehensive protection.

How Much Does Federally Subsidized Livestock Insurance Cost?

The cost of a federally subsidized livestock insurance policy depends on several factors, including the coverage level you choose, the type of livestock insured, and market conditions. However, because these policies are federally subsidized, producers receive significant discounts on premium costs. These subsidies make it an affordable option for many livestock producers who may not otherwise be able to bear the full cost of coverage.

Factors That Influence Cost:

- Type of livestock: Different livestock, such as swine or cattle, may have different risk profiles.

- Market conditions: Fluctuating market prices can influence the cost of premiums.

- Coverage levels and duration: Higher coverage levels or longer insurance periods may lead to higher premiums.

How to Purchase Federally Subsidized Livestock Insurance

Federally subsidized livestock insurance is available through private insurance companies that have partnered with the FCIC. There are currently 10 companies offering these products (this number may change over time) through agents appointed and authorized through them. Because the rates and premiums are standardized by the FCIC, you can expect the same cost and coverage no matter which company you choose.

To purchase a policy:

- Work with an authorized agent who can guide you through the application process.

- Submit your application and establish eligibility well before you need to purchase an endorsement.

- Once your eligibility is confirmed and a policy issued, you can endorse your policy to attach insurance coverage for the desired level of protection.

Conclusion

Federally subsidized livestock insurance is a valuable resource for producers looking to mitigate risks and protect their investments. With options like Livestock Gross Margin (LGM) and Livestock Risk Protection (LRP), producers can find the coverage that best fits their needs while benefiting from premium subsidies.

To explore your options and ensure your livestock is protected, reach out to an authorized agent today and begin the process of securing your operation’s future.