Protecting Your Business from Water Damage

Flooding can cause significant damage to businesses, leading to costly repairs and potential financial setbacks. Unfortunately, standard commercial property insurance typically does not cover flood damage. For businesses, having the right flood insurance can mean the difference between swift recovery and overwhelming loss. Whether your business is in a high-risk flood zone or a moderate-risk area, understanding commercial flood insurance is vital for protecting your investment.

Why Your Business Needs Flood Insurance

Floods are unpredictable and can happen anywhere—not just in high-risk zones. In fact, about 20% of flood claims come from properties located outside of high-risk flood areas. With the potential for flooding across various regions, businesses of all sizes should consider flood insurance.

- Mandatory Coverage: Businesses located in Special Flood Hazard Areas (SFHAs) may be required to carry flood insurance, especially if the property is financed by a federally regulated lender. This requirement ensures that your property can be repaired or rebuilt if it’s damaged by a flood.

- Voluntary Coverage: Even if your business is located in a low- or moderate-risk area, voluntary flood insurance offers valuable protection against unforeseen flooding events. Investing in coverage can safeguard your business from unexpected water damage, reducing potential financial losses.

What Commercial Flood Insurance Covers

Commercial flood insurance is designed to protect both the physical structure of your business property and its contents. The National Flood Insurance Program (NFIP) offers coverage for these essential areas:

Building Coverage

This part of your policy covers damage to the physical structure of your business, including:

- The building’s foundation

- Electrical and plumbing systems

- HVAC systems (heating, ventilation, and air conditioning)

- Permanently installed equipment and fixtures

Whether your business is housed in a single-floor building or a multi-story facility, building coverage is essential for ensuring that structural repairs can be made in the event of a flood.

Contents Coverage

Contents coverage protects the items inside your building that are necessary for day-to-day operations, including:

- Inventory and merchandise

- Furniture and office equipment

- Removable fixtures and other business property located inside the building

By covering your business’s contents, you can avoid costly replacements of critical items that keep your operations running smoothly.

What’s Not Covered by Commercial Flood Insurance

While flood insurance provides valuable protection, it’s important to know what’s not covered. Some exclusions include:

- Property located outside the insured building, such as landscaping, fences, and septic systems

- Vehicles, which require separate comprehensive auto insurance for flood-related damage

- Business interruption costs, meaning lost income during the time your business is unable to operate due to flood damage

- Mold damage, unless it’s directly caused by the flood and specific conditions are met

- Currency, precious metals, and valuable papers are also not covered, so extra steps may be needed to protect these assets

Understanding these exclusions helps you plan for additional coverage options where necessary, such as adding business interruption insurance or vehicle protection.

How Much Does Commercial Flood Insurance Cost?

The cost of flood insurance for businesses varies depending on several factors. Some of the key factors that influence your premium include:

- Location and Flood Risk Zone: Properties in high-risk areas will typically have higher premiums.

- Building Age and Construction: Older buildings or those built below the base flood elevation may face increased costs.

- Number of Floors: Multi-story buildings with contents located on upper floors may have lower premiums than single-story buildings.

- Location of Contents: Storing valuable items above ground level can reduce flood risk and insurance costs.

- Coverage Amount: The more coverage you purchase for building and contents, the higher your premium.

- Chosen Deductible: Higher deductibles result in lower premiums but increase your out-of-pocket costs in the event of a flood.

Coverage Limits

Under the National Flood Insurance Program, there are limits to the amount of coverage available:

- Building Coverage: Up to $500,000

- Contents Coverage: Up to $500,000

For businesses requiring more protection, excess flood insurance can be purchased through private insurers. This coverage goes beyond NFIP limits, providing additional security for high-value properties or businesses with significant assets.

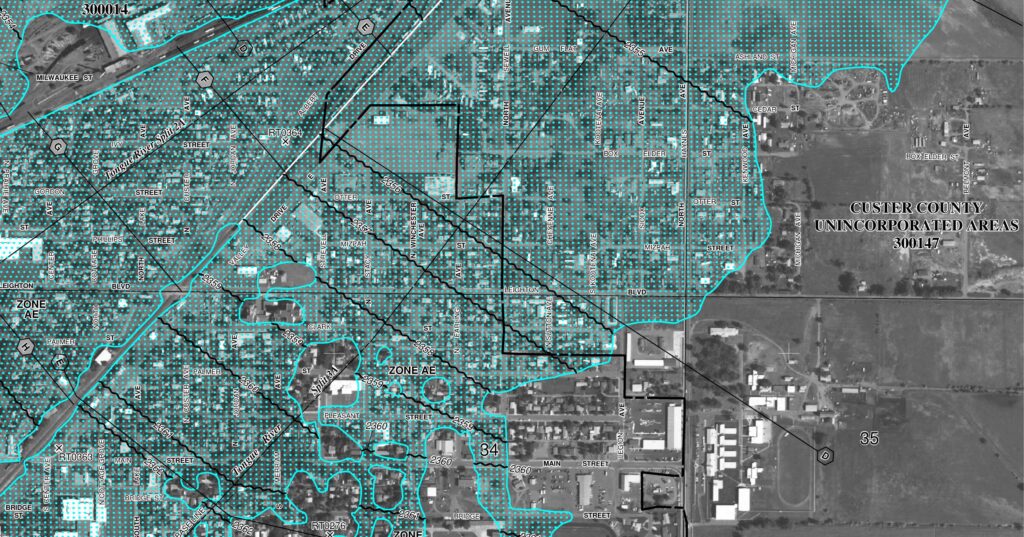

Determining Your Business’s Flood Risk

To determine your flood risk, FEMA’s Flood Insurance Rate Maps (FIRMs) are a valuable resource. These maps show the areas of highest risk and help businesses understand their flood exposure. Properties in higher-risk zones will likely face mandatory insurance requirements, while those in lower-risk zones may have the option to purchase insurance voluntarily.

Your flood risk directly impacts insurance costs and coverage requirements, so it’s essential to understand your business’s specific location on FEMA’s flood map.

When Flood Insurance Is Optional but Recommended

Even if your business isn’t located in a high-risk flood zone, flood insurance is still a smart investment. Flooding can occur from heavy rains, flash floods, or other natural events, and no area is completely immune. Having coverage in place protects your business from unexpected water damage, ensuring you can quickly recover and continue operations.

By choosing to voluntarily protect your business, you safeguard the investment you’ve made in your property, equipment, and inventory.

Conclusion

Commercial flood insurance is an essential part of protecting your business and ensuring its continuity after a flood event. Whether your business is located in a high-risk area with mandatory flood insurance requirements or in a low-risk zone where coverage is voluntary, having the right protection can prevent significant financial loss and disruption.

Assess your business’s specific needs and risks today and speak with a licensed insurance agent to get a quote. With the right flood insurance coverage, you can ensure your business stays resilient in the face of unexpected flooding.